are raffle tickets tax deductible australia

If the gift is property the property must have been purchased 12 months or more before making the donation. M of NSW 707617.

Tax Deductible Donations An Eofy Guide Good2give

In other words charities that sell raffle tickets items or food to raise money cannot benefit from tax-deductible gifts as they are not able to claim these deductions.

. When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their contribution as a tax deduction. For example if you bought 100 worth of raffle tickets that did not win but won 500 on a 5 raffle. Raffle tickets are not tax deductible.

The IRS considers a raffle ticket to be a contribution from which you benefit. Exceptions for Charity Raffle Donations. Raffle tickets and lottery syndicates.

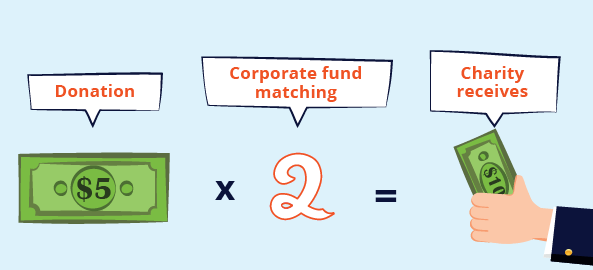

Basically the IRS treats it like gambling or specifically nondeductible gambling losses because youre not selflessly donating to charity but rather playing the odds in hopes of. 1500 for contributions and gifts to independent candidates and members. Any donation that meets this criteria is considered a tax deductible donation which means you can deduct the amount of your gift from your taxable income on your tax return.

No-one wants to count all the change in all the charity tins but a report in 2018 found the average annual claim for tax deductible donations was 63372. Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had gambling winnings of at least that amount. However if you want to claim more than 10 you will need a.

However many of these crowdfunding websites. A of ACT 293466. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

First of all if you receive a raffle ticket dinner attendance event entry chocolates or anything like that then your donation cant be claimed as a deduction. Websites like Zacks provided some of the most clarity on how the IRS treats charity raffle tickets. Raffle tickets and lottery syndicates Unfortunately contributing to the monthly office sweep is not a deductible expense and neither are raffle tickets or lottery syndicates.

Hi I am a bookkeeper for a small not for profit neighbourhood centre in NSW. This is because the purchase of raffle tickets is not a donation ie. Are raffle prizes considered income.

To qualify for a deduction the contribution must meet all the conditions for a tax deductible contribution. Please use the ACNC Charity Register to determine if a charity has received DGR approval. Generally you can claim donations to charity on your individual income tax returns.

Basically if you receive something because of your donation then dont claim the donation as a tax deduction. We plan to run a raffle in order to raise funds. Thats averaging out claims by the likes.

Regular Raffle Supporter Winner. You can claim up to 10 for coin bucket donations without needing a receipt. Are raffle tickets tax deductible.

Some donations to charity can be claimed as tax deductions on your individual tax return each year. Ticket number 081455 G of VIC Early Bird Winner. A of VIC 122529.

To claim a deduction. 330324 b of melbourne vic 3207 No under current australian government taxation legislation the cost of raffle tickets is not tax deductible. 3 donations you can claim on tax.

Credit Card Bonus Winner. Your gift or donation must be worth 2 or more. You cannot deduct the costs incurred in order to support a nonprofit organization through a raffle.

Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Any donation that meets this criteria is considered a tax deductible donation which means you can deduct the amount of your gift from your taxable income on your tax return.

In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. Raffle Tickets even for a charity are not tax-deductible. No lottery tickets are not able to be claimed as a tax deduction.

230349 J of VIC. 25 Jul 2017 QC 46264. This means that purchases from a charity that involve raffle tickets items or.

C of ACT 718493. An affidavit of eligibility provided by special olympics arizona may be required from prize winners. For a donation to be tax deductible it must be made to an organisation endorsed as a Deductible Gift Recipient DGR and must be a genuine gift you cannot receive any benefit from the donation.

In accordance with Australian Tax Office guidelines if you receive a lottery ticket in return for your transaction then your purchase cant be claimed as a deduction. The only time you can deduct the cost of raffle tickets you purchase from a charity is when you report any type of gambling winnings on the same return. In fact to claim donations you need to be donating to a recognised charitable organisation.

Tax re prizes bought for employee charity raffle. If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater than the value of the benefit you receive. All prizes will be donated by local businesses.

GST and revenue on sale of raffle tickets - not for profit organisation in NSW.

How To Claim A Tax Deduction On Christmas Gifts And Donations

Tax Deductible Donations An Eofy Guide Good2give

Sofii In Memoriam Donation Thank You Letter Samples Donation Thank You Letter Donation Letter Template Thank You Letter Template

![]()

Donations And Deductions Bishop Collins

Are Raffle Tickets Tax Deductible Australia Ictsd Org

Tax Deductible Donations Reduce Your Income Tax The Smith Family

Are Charity Auctions Tax Deductible Australia Ictsd Org

Are Lottery Tickets Tax Deductible In Australia Ictsd Org

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Raffle Tickets Auction Fundraiser

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Donations What S Tax Deductible What S Not Canberra Citynews

How To Claim Tax Deductible Donations On Your Tax Return

501 C 3 501c3 Donation Receipt Template